Facts About Guided Wealth Management Revealed

Facts About Guided Wealth Management Revealed

Blog Article

Guided Wealth Management - The Facts

Table of ContentsOur Guided Wealth Management PDFsNot known Details About Guided Wealth Management The 30-Second Trick For Guided Wealth ManagementEverything about Guided Wealth ManagementSome Known Factual Statements About Guided Wealth Management

Be alert for possible problems of passion. The advisor will certainly set up a possession allotment that fits both your danger tolerance and threat ability. Asset appropriation is simply a rubric to establish what percentage of your overall monetary portfolio will be distributed across different possession classes. An even more risk-averse person will certainly have a greater concentration of government bonds, deposit slips (CDs), and cash market holdings, while an individual that is more comfortable with risk may decide to tackle more supplies, company bonds, and perhaps also investment property.

The average base pay of a monetary expert, according to Without a doubt as of June 2024. Note this does not consist of an estimated $17,800 of annual commission. Any individual can deal with a monetary advisor at any type of age and at any phase of life. retirement planning brisbane. You don't have to have a high total assets; you just have to discover an expert suited to your situation.

The 8-Minute Rule for Guided Wealth Management

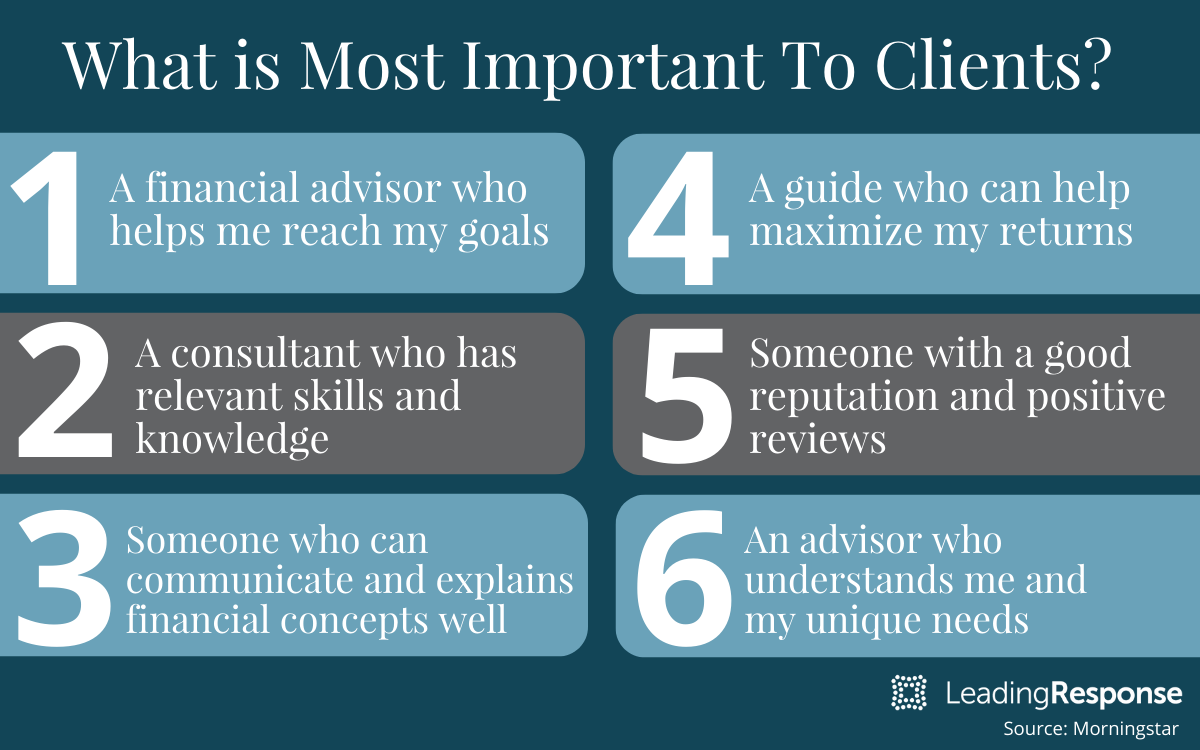

Financial advisors function for the client, not the company that uses them. They must be responsive, willing to clarify economic ideas, and keep the customer's finest rate of interest at heart.

An advisor can recommend possible improvements to your strategy that may help you attain your objectives much more properly. Lastly, if you don't have the moment or passion to manage your funds, that's one more excellent factor to employ an economic consultant. Those are some general reasons you could need an expert's professional assistance.

A great economic advisor shouldn't just sell their solutions, but give you with the tools and resources to become financially savvy and independent, so you can make enlightened choices on your own. You want a consultant that remains on top of the financial scope and updates in any area and who can answer your economic inquiries concerning a myriad of subjects.

Guided Wealth Management Can Be Fun For Anyone

Others, such as certified financial coordinators(CFPs), already adhered to this criterion. However even under the DOL regulation, the fiduciary standard. financial advisor brisbane would certainly not have related to non-retirement recommendations. Under the suitability criterion, economic experts usually deal with compensation for the products they offer to clients. This indicates the client might never ever get a bill from the monetary consultant.

Costs will likewise differ by area and the advisor's experience. Some consultants might supply lower prices to assist clients who are just getting going with monetary preparation and can't pay for a high month-to-month price. Commonly, a monetary expert will certainly offer a cost-free, initial assessment. This examination gives a possibility for both the client and the consultant to see if they're a good suitable for each various other - https://www.pageorama.com/?p=guidedwealthm.

A fee-based consultant might make a charge for establishing an economic strategy for you, while likewise making a compensation for offering you a specific insurance item or financial investment. A fee-only financial expert gains no compensations.

The smart Trick of Guided Wealth Management That Nobody is Talking About

Robo-advisors don't need you to have much money to get started, and they cost less than human monetary experts. A robo-advisor can't talk with you concerning the finest means to get out of debt or fund your kid's education and learning.

A consultant can assist you figure out your cost savings, how to go to this site build for retirement, help with estate preparation, and others. Financial experts can be paid in a number of means.

Top Guidelines Of Guided Wealth Management

Marriage, separation, remarriage or just moving in with a brand-new partner are all landmarks that can call for cautious planning. For example, together with the usually tough psychological ups and downs of separation, both partners will need to handle essential economic considerations (https://guided-wealth-management-46914230.hubspotpagebuilder.com/guided-wealth-management/your-guide-to-financial-freedom-with-a-financial-advisor-in-brisbane). Will you have enough revenue to sustain your way of living? Just how will your investments and various other possessions be split? You might extremely well need to transform your financial approach to keep your goals on course, Lawrence says.

An unexpected increase of cash or possessions elevates immediate inquiries concerning what to do with it. "A financial expert can assist you think through the means you could put that cash to work toward your individual and economic goals," Lawrence claims. You'll intend to believe about how much can go to paying down existing financial debt and how much you could consider investing to go after an extra secure future.

Report this page